By Blue Horizon (Przemek Obloj, Friederike Grosse-Holz, Sophie Bergmann) and Olon (Deborah Davies, Andrea Conforto)

We thank our contributors: Enough (Craig Johnston), GFI (Liz Specht, Lucas Eastham, Adam Leman), Motif (Philippe Prochasson), Mycotechnology (Alan Hahn), Planetary (David Brandes, Joachim Schulze), Synonym (Brentan Alexander, Edward Shenderovich)

About Olon: Olon Biotech is an Italian CDMO providing microbial fermentation, development and scale-up solutions utilising a variety of bacterial, yeast and fungal systems. Across our 2 CDMO sites we offer 4500 m3 fermentation capacity with lab, pilot and commercial scale fermenters complemented with a range of DSP suites. With dedicated areas for pharma and food-grade manufacturing we comply to cGMP (FDA and EMA approved) and GFSI (FSSC 22.000). Our experienced teams work in partnership with clients to develop customised processes that deliver client requirements at scale.

About Blue Horizon: Blue Horizon is accelerating the transition to a Sustainable Food System that delivers outstanding returns for investors and the planet. The company is a global pioneer of the Future of Food. As a pure play impact investor, Blue Horizon has shaped the growth of the alternative protein and food tech market. The company invests at the intersection of biology, agriculture and technology with the aim to transform the global food industry. Blue Horizon was founded in 2016 and is headquartered in Zurich, Switzerland. To date, the company has invested in more than 70 companies. Its business model offers an attractive opportunity to invest in the evolution of the global food system while contributing to a healthy and sustainable world. www.bluehorizon.com

1. Executive summary

Biomanufacturing, the production of food ingredients and other materials via microorganisms, is emerging as a promising building block for a more sustainable, healthier and resilient economy – the bioeconomy. While many biomanufacturing processes exist at the “proof-of-concept” level, or at small scale and high cost in the pharma industry, scaling biomanufacturing of food and materials up to industrial volumes is the key next step in building the bioeconomy.

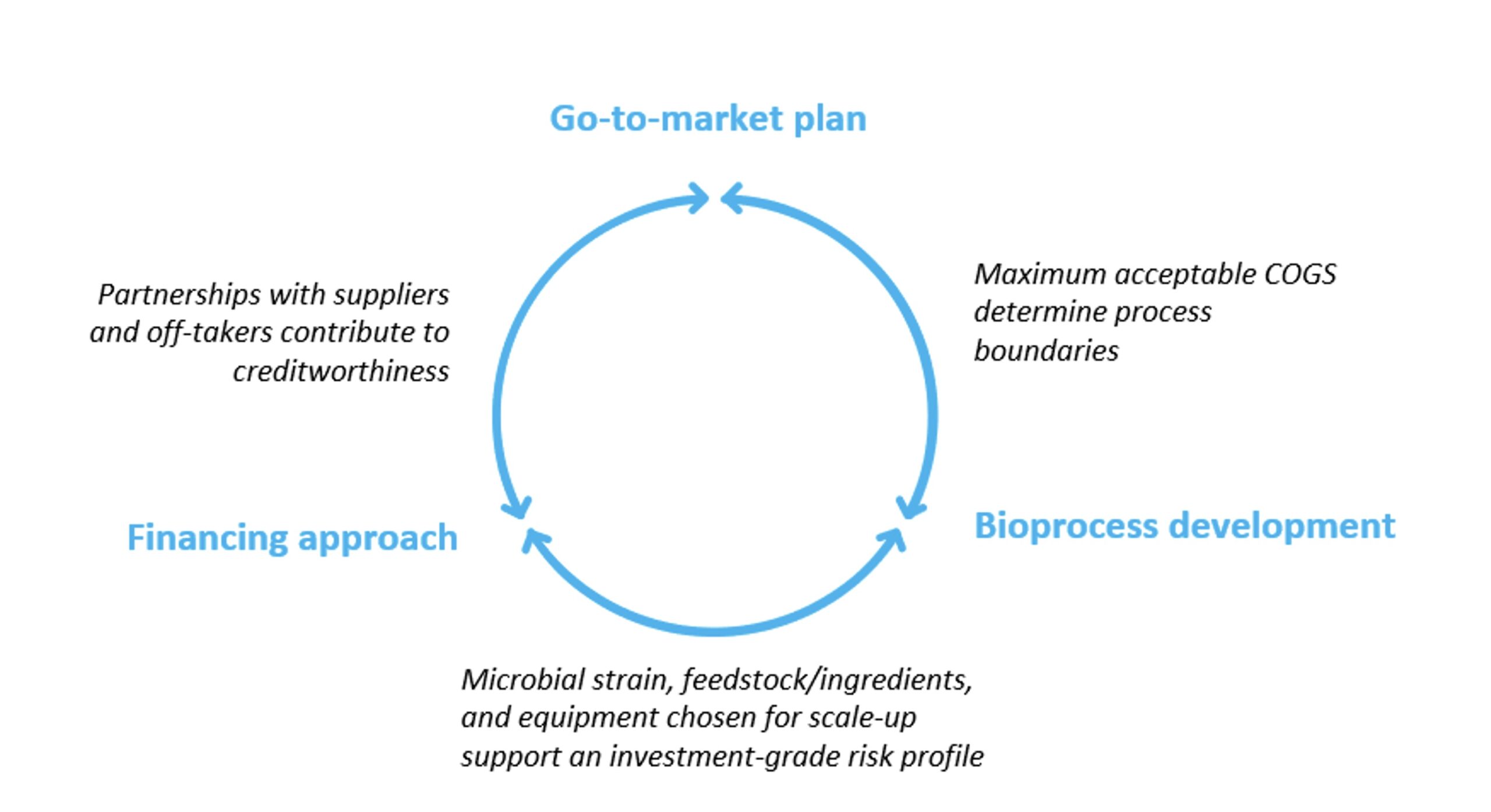

This report identifies three main themes in scaling up biomanufacturing.

First, the end product and go-to-market effectively determine the price, and therefore the maximum acceptable cost of running the biomanufacturing process. Thoughtful iterations between go-to-market planning and process development thus become the core of a bioeconomy business plan. Where demand elasticity is low and low-cost alternatives are lacking, a higher cost of production may be acceptable; in commodity markets, however, companies with high-cost processes will be left chasing elusive premia.

Second, strain selection and process development are a multi-parameter optimization challenge. Choosing between the three most used types of microorganisms (and possibly the many more novel ones), selecting media ingredients, and deciding whether to scale up or to scale out all need to be considered in context. These choices are what makes or breaks scalability of the process – thus, the likelihood of success increases if the biomanufacturing process is developed with scale in mind.

Third, scaled-up biomanufacturing processes need scaled-up infrastructure to run on, and financing such innovative infrastructure poses a sizeable challenge. Possible sources of capital range from shareholders equity, public subsidies and grants to various forms of debt – any and all of them will likely be needed. Where this financing journey is sketched out early, businesses can be built with creditworthiness in mind, unlocking access to lower cost of capital.

Figure 1. Scaling the Bioeconomy in an Iterative Strategic Approach

2. Introduction

Our world is full of microorganisms – but their full potential is yet to be unlocked

Our planet is home to 1011 to 1012 species of microorganisms, more than there are stars in our galaxy, the milky way. However, an estimated 99,99% of microorganisms remain unexplored: A recent study catalogued over ten thousand new strains at once, highlighting the potential of novel methods to identify and analyse more microorganisms than ever before.

At the same time, a 2020 report by BCG estimates that by 2060, the amount of organic materials required globally will have doubled to around 167 billion tonnes. Such materials are currently mostly extracted from earth. Notably, a total of 62% of global greenhouse gas (GHG) emissions are caused during material extraction and processing, and emissions are only set to increase with increasing demand.

What if we could enlist the vast microbial diversity to produce organic materials like food, fabrics or building materials, and build a greener, healthier, more circular economy – the bioeconomy (see glossary)?

The scientific basis for microbial-based technologies is already established

Using fermentation (the growth of microorganisms, see glossary) to produce and modify foods is nothing new; products like bread, beer, yoghurt, or citric acid are all routinely made in this way. The pharma industry also uses microorganisms as miniature drug factories, for instance for insulin. The bioeconomy now expands the use of fermentation to innovative foods and biomaterials. Examples in the food space from Blue Horizon’s portfolio include production of animal-free egg white proteins by EVERY, a range of food colours by Chromologics, and food ingredients for enhanced colour, texture and taste by Motif. Many more companies are active in this space, as outlined in the Good Food Institute’s report. Further upstream in the food value chain, Blue Horizon portfolio company Agbiome creates crop protection solutions from microorganisms.

And the bioeconomy extends well beyond food: Checkerspot produces a range of performance materials, showcased in skis and snowboards under their consumer brand Wonder Alpine. Blue Horizon portfolio companies Polybion and Geltor use microorganisms to manufacture leather and collagen, respectively. Meanwhile, Biomason manufactures cement, and Lumen Biotechnologies develops edible vaccines.

The bioeconomy is largely a fermentation economy

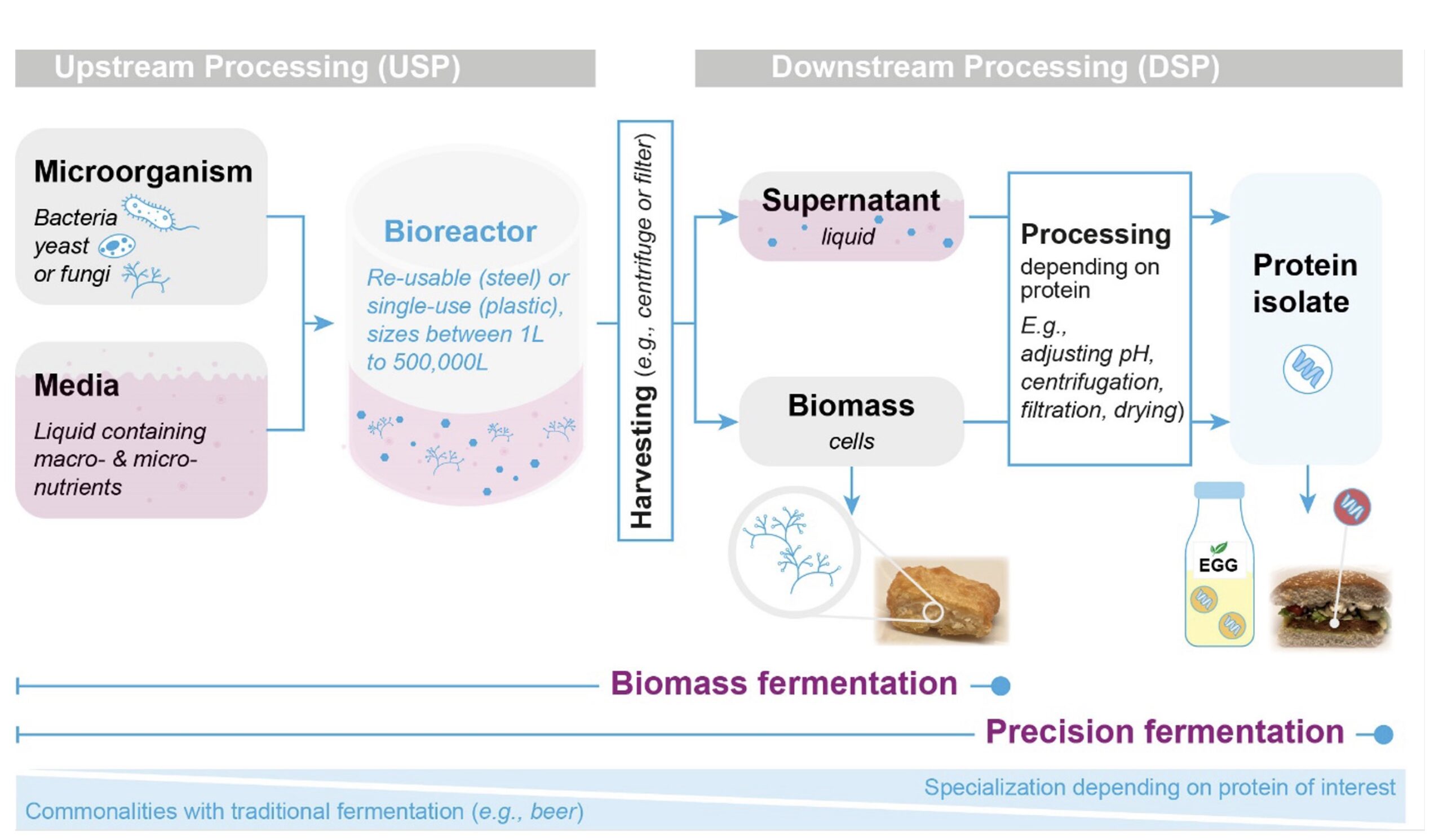

The process of microbial fermentation underlying the aforementioned bioproducts, from food ingredients to skis to cement, is similar (see box 1). As an example, the microbial production of food ingredients is shown below.

Microbial fermentation process overview

- Step 1: A microorganism that will produce the desired target material is selected or engineered.

- Step 2: Upstream process (USP): The microorganisms are grown in a media-containing bioreactor, also called fermenter. The media provides nutrients for the microorganisms.

- Step 3: The target material is harvested from the fermenter. The downstream processing (DSP) differs depending on the used microorganism and target material. Harvesting can target the whole microorganism (biomass fermentation) or involve several steps of separation via centrifuges and filters to target only specific proteins or other molecules produced by the microorganism (precision fermentation).

Figure 2. Microbial fermentation.

The immense, unique opportunity to establish a bioeconomy has been recognized in recent years: For instance, the U.S. National Biotechnology and Biomanufacturing Initiative (NBBI) accelerates innovation and research, and leverages biomanufacturing in the United States.

The promise of the bioeconomy is vast, but cost efficiency and scale up must be improved

To realize the bioeconomy’s potential to supply a growing population with sustainable, high-quality food and materials, these innovative fermentation processes need to be scaled up. Many of the aforementioned companies have conducted initial tests and tastings, but almost none are yet producing at the scale and cost they will need to reach to sell into food and materials markets.

Relatively simple fermentation processes such as beer production are routinely conducted in fermenters of tens to hundreds of thousands of litres in size. For pharma, the manufacture of antibiotics is likewise high volume, low cost whereas more recent pharma developments for complex molecules have been established with high reproducibility but at small scale and high cost. Scaling the bioeconomy means walking the tightrope in between these worlds: Establishing innovative, more complex fermentation processes that produce specific food ingredients or materials, at a scale and cost base that encourages uptake in the market.

This report summarizes three main challenges of scaling up biomanufacturing and proposes approaches to tackling these challenges to unlock a bright, bioeconomy-based future.

Glossary

The bioeconomy is an economy based on biomaterials, many of which are produced via fermentation.

Fermentation describes the production and processing of materials using microorganisms. Historically, fermentation commonly referred to fermentation-enabled food production, but emerging technology now enables the creation of a wide variety of organic materials. Microorganisms used for fermentation include bacteria such as Escherichia (E.) coli, yeast such as Pichia pastoris, or fungi such as Trichoderma reesei.

Precision fermentation uses microorganisms as ‘factories’: A microorganism producing a specific material of interest is selected, or a “host” microorganism provided with the genetic code for the target material. Microorganisms then produce the target material during cultivation in a fermenter. The target material is extracted from the microbial host and subsequently purified. Examples include food ingredients like heme, which delivers red colour and meaty taste.

Biomass fermentation differs from precision fermentation as the microbial host itself is not separated from the target material and serves as its main component. Examples include whole foods based on mycelium.

Upstream Processing (USP) describes the seed and growth of microorganisms producing the material of interest in nutrient-supplemented media, which takes place in a bioreactor (fermenter). USP using bioreactors is similar across many types of products.

Downstream Processing (DSP) refers to the processing and purification of microorganisms and/or produced proteins. DSP infrastructure varies significantly in complexity depending on the harvested material.

3. Key challenges and approaches of bioeconomy scale-up

Challenge 1: Defining a go-to-market strategy – What’s the target price, and what does that imply for the maximum acceptable production cost?

One may approach biomanufacturing from a vantage point of product need, where unsustainable and/or scarce products are replaced with biomaterials. Alternatively, one may approach from a vantage point of technology, to provide the bio-based “killer application” for a breakthrough development. In either case, selecting the product(s) to bring to market throughout a business’s life is the first pivotal choice, as the ability of the product to produce sufficient margins to mitigate business risks is of paramount importance when seeking financing for business growth. Detailed techno-economic modelling (“TEM”) that accounts for capital costs, operating costs, and site-specific factors is a necessary step in making an informed decision on the first product. Unsurprisingly, product value (customer “willingness to pay”) is a key driver of these models, for different products and value can vary drastically for products with similar manufacturing cost structures. Products may fall into one of two categories:

- High-value ingredients are minor ingredients with major impacts. They may comprise a low percentage in the final product but add flavour or functionality. These ingredients can cost in the range of $20 – $1000/Kg.

- One example is heme, a functional ingredient enhancing the appearance, nutrition and taste of plant-based meat, which accounts for between 0.25 and 1.5% in a plant-based burger patty.

It is worth noting that as alternatives to the currently high-value ingredients become more available and used in a wider range of applications the volumes will increase, and the market expectation will be for lower pricing. For instance, many formerly pricey “specialty chemicals” are now commoditized, like polyethylene terephthalate (PET), which transformed from a higher margin specialty chemical in the mid-1990s into a commoditized product by 2010.

- Bulk or low-cost ingredients tend to add less functionality but provide the body on which a product is built. While they often offer lower margins, bulk ingredients tend to address the largest markets. For these ingredients to compete or replace existing alternatives, they typically need to meet a target cost in the range of $1s – $10s /kg.

- One example is filamentous fungi-derived mycoprotein, which is the main component of some animal-free meat alternatives.

Given these distinct profiles, one may plan to launch in a market niche with a higher willingness to pay (e.g., high-value ingredients) even if the total addressable market in this niche is small. Establishing a foothold in such niches may be possible even with a not-yet fully optimized process. Over time one can then work to reduce cost of goods sold (COGS) to the levels acceptable in larger commodity markets (e.g., bulk ingredients) as production is scaled up. However, this approach of “landing” in a niche and then expanding from there is not a silver bullet. Lower cost capital sources may look at specialty markets as riskier, depending on the credit quality of the buyers, the price history in the market, and the risk of market commoditization over the life of a facility. The structure of off takers and offtake agreements available for different products is thus an important consideration in identifying the best first market to enter.

Challenge 2: Developing a scalable process – Which microorganism and which process can deliver the necessary production cost and scale?

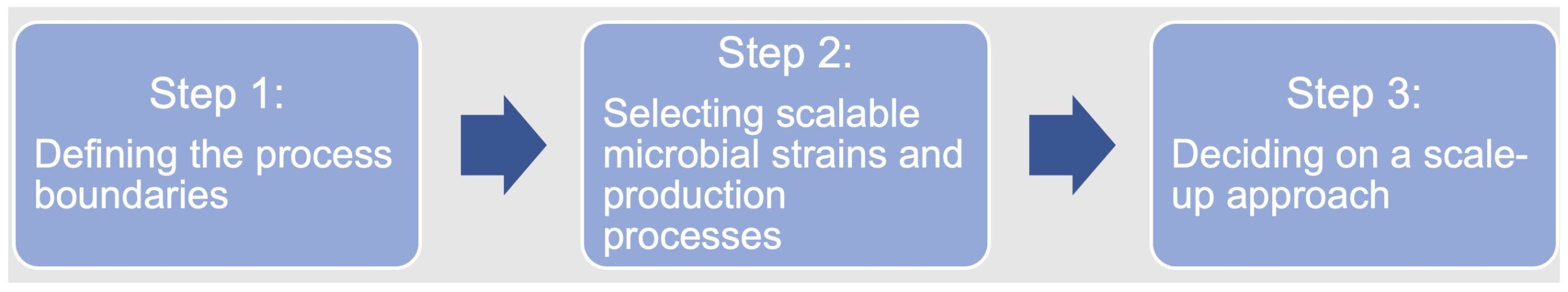

The initial go-to-market strategy can inform development of a scalable process that meets the product specification along three steps:

Step 1: Defining the process boundaries

Following the target COGS and market pricing at each stage of scale-up, process boundaries can be defined by breaking down COGS into its key drivers, such as:

- Production titre (g/L of target product in the fermenter)

- Media cost ($/L)

- Growth time (hours/batch)

- Energy costs ($/kWh, calculated for each batch)

- Downstream processing (DSP) efficiency (% of product retained following DSP)

Process boundaries are highly inter-dependent. One may select a microorganism capable of high titres, but this microorganism may then have a long growth cycle. Both growth rate and titres may be increased using a highly nutritious feedstock, but the cost of the carbon source (sugar) will increase the COGS. Many such trade-offs must be carefully considered.

One key driver of COGS are energy costs: Depending on the process at hand, up to one-third of COGS are energy costs. Energy costs are highly location dependent, with sites within driving distance of each other sometimes having wildly different electricity rates depending on the utility servicing the area. Consideration of locally produced green energy and/or synergies with energy (e.g., heat, steam, etc.) producing facilities may offer attractive opportunities to lower energy costs depending on the local utility system. Alongside energy costs, facility location also has large impacts on the timeframes of construction, feedstock availability and cost, and the cost and pool of suitably trained workers. As a result, location choice of fermentation facilities is a key driver of COGS, and a poorly sited facility can be markedly more expensive to operate than one that is carefully sited.

Step 2: Selecting scalable microbial strains and production processes

The likelihood of meeting the target COGS outlined in the go-to-market plan increases drastically if strain selection and process design are geared towards those targets from the start.

Key considerations for microbial strain selection

Main properties for established microbial strains are highlighted in Table 1. They influence strain selection, including:

- Titre of produced target material in fermentation broth

- Titres vary vastly between strains, from up to 80 g/L for E. coli, 65 g/L for filamentous fungi, to 20 g/L for Pichia

- High concentrations can simplify purification and lower costs.

- Microbial growth rate

- The microbial growth rate determines the duration of fermentation.

- The doubling time, that is the time each cell division takes and a key driver of growth rates, varies vastly between microbial strains. Doubling times range from around 20 minutes for E. coli to 1 to 3 hours for Pichia pastoris.

- Fermentation duration can therefore be up to 2 times longer in Pichia and 3-4 times longer in filamentous fungi compared to E. coli.

- Raw materials for microbial feed

- Materials for microbial feed influence the cost of fermentation media, and in particular, the choice of carbon source. Partnerships with other industries can offer savings potential, e.g., to valorise food industry side streams. One example is MycoTechnology, which uses locally harvested, surplus dates.

- Key raw materials usually include a carbon source (typically glucose or glycerol, unless industry side streams can be used), a Nitrogen source (e.g., Ammonia) and any other nutrients the microorganism in question needs.

- The availability at scale, the specification and consistency of supply for key raw materials can be important factors in developing a scalable process.

- Applicability for efficient DSP

- While early-stage process development often focuses on the upstream fermentation, DSP speed and efficiency can become limiting steps for industrial-scale bioprocesses.

- Using a microbial system (microorganism plus media) for which standardized, low-complexity DSP protocols exist can thus be an important consideration during strain selection

- The DSP process is designed to meet a specification, so it is important to set the right specification for each target market. The complexity of the DSP process increases if the target is expressed intracellularly, has complex characteristics, and where a high purity is required. This will increase DSP time and therefore cost.

- Besides duration, yield is a key indicator of DSP efficiency. The final yield describes what proportion of the target material can be purified from the fermentation broth vs. how much is lost along the way. For instance, final yield for filamentous fungi can be around a third higher than for MeOH-induced Pichia.

Additional considerations for microbial strain selection

Additional considerations include protein folding efficiency, and undesirable growth media components. Even though E. coli offers high titres, mis-folding of produced proteins occurs frequently. An abundance of misfolded proteins in the media causes stress and can be toxic to the host cells. Pichia pastoris provides more reliably correct protein folding, but it grows more slowly. Methanol (MeOH) dependent Pichia strains may grow faster but since additional safety provision is required to handle MeOH this could limit the choice of fermentation partners.

Taken together, the perfect organism does not (yet) exist. So-called “wild” strains, which are microorganisms that produce a material of interest but have not yet been used on industrial scale, offer great potential to explore. However, they also pose risks: each strain’s capabilities and limitations need to be investigated early on to develop a plan for robust scale-up and avoid unforeseen, additional costs during scale-up.

Key considerations for process design

Understanding the Process boundaries during USP and DSP are key to supporting the design of a scale-up ready process.

In addition to those boundaries, the following considerations can help avoid pitfalls on the journey to market launch.

Complex lab-scale media ingredients can make sense during feasibility but may not be suitable at commercial scale. If kosher and/or halal certification is needed, compliance of the raw materials needs to be ensured, and use of animal-derived ingredients avoided. Similarly, the use of antibiotics during fermentation stages may be unacceptable both to consumers of the final product and potential manufacturing partners.

A regulatory strategy should be established early on. Once it is clear which regulatory pathway a product will follow (e.g., novel food vs. ingredient in the EU, (self-)GRAS in the US), the necessary data can then be produced in the first production cycles.

Brownfield facilities (i.e., existing facilities that can be adjusted to the required process) can offer a cost-effective path to scale-up. While the fermenter and DSP equipment itself may need replacing, the infrastructure for utilities like water, pressurized air, energy etc, can sometimes be obtained at comparatively low cost. It should be noted, however, that brownfield facilities may be outdated and less efficient than state-of-the-art designs. This may lead to higher overall COGS, so a potential trade-off between a lower upfront spend against higher ongoing operating costs must be carefully considered in the TEM.

Step 3: Deciding on an approach to increase production volumes

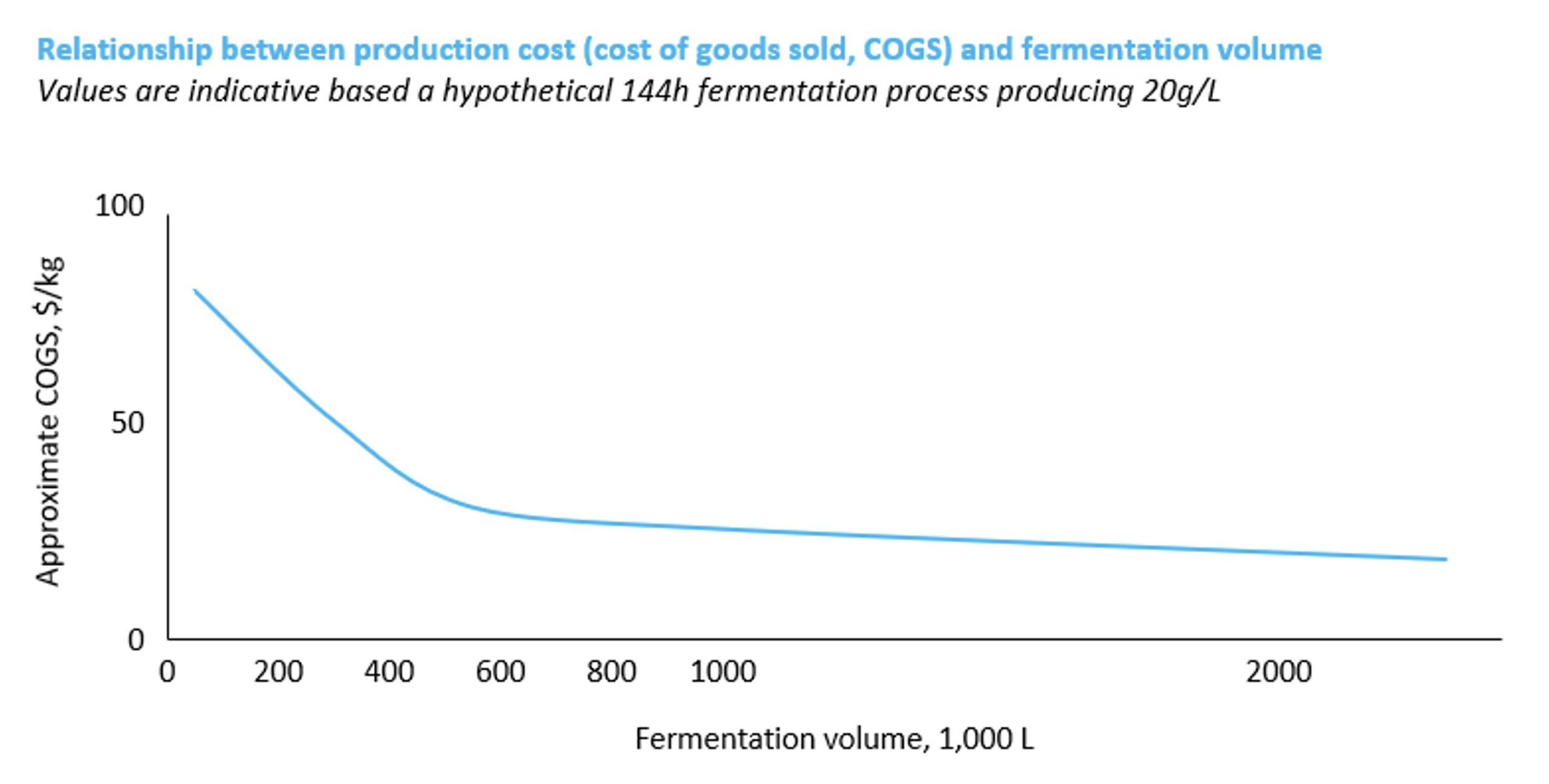

‘For many fermentation-based food products, production volumes of multiple hundreds of thousands of litres will be needed to reach competitive COGS’, states David Brandes, Co-founder and CEO of Planetary, a global contract manufacturing and development organisation (CDMO) and Blue Horizon portfolio company. Figure 2 highlights the impact that economies of scale have on production cost, showing indicative COGS for a hypothetical microbial fermentation producing 20 g/L of the target molecule in the upstream process over 144h. Assumptions on all parameters like media composition and DSP will of course depend on the specific process, hence absolute figures are only indicative – the key point illustrated here is the relationship between production cost and scale.

Figure 3. Impact of fermentation volume on production cost

The two main approaches to increase upstream production are scaling up (i.e., increasing capacity to larger-volume bioreactors) and scaling out (i.e., adding capacity by using additional, smaller fermenters).

- Scaling up offers straightforward economies of scale but increases technical complexity. For instance, stirring very large fermenters is highly energy-intensive, and friction through stirring creates heat, necessitating further energy for cooling. Foaming, easily managed in smaller vessels, can become a problem. And in case of contamination with undesired microorganisms, a big (and potentially very expensive) batch is lost.

- Scaling out lowers the risks of losing large volumes at once due to contamination. Replicating an established process in additional fermenters is also technically less risky than adapting a process for a larger volume. However, smaller-scale bioreactors usually have proportionally higher material, installation, maintenance and operation costs per litre of production volume, compared to larger-scale fermenters.

The decision to scale up or to scale out will thus depend on several cost-benefit analyses – e.g., whether the likelihood of contamination and/or the cost of media per batch is high enough that it seems cheaper to scale out and accept higher running costs per production volume than to risk losing a small number of batches in a big fermenter.

Scale-up also frequently faces the challenge of being somewhat unprecedented – even if a specific microorganism has been used at 100,000L scale to produce one material, unforeseen challenges can arise when the same microorganism is used to produce something else. For instance, foaming can depend a lot on which target material a microorganism is producing.

Challenge 3: Financing biomanufacturing capacity – How do we pay for the steel?

Once the scale-up-ready process is developed, it requires high-capacity production facilities. Currently, biomanufacturing capacity is scarce: Only 12 facilities with 200,000L fermentation capacity or more are listed by capacitor.bio, a global database for microbial fermentation infrastructure recently launched by Synonym in cooperation with Blue Horizon. And as discussed above, 200,000L may be on the smaller side of what would be needed for mass-market foods or materials. This contrasts to at least 125 manufacturers of fermentation-derived innovative food products recorded in GFI’s database in 2022, of which many will need multiple large-scale facilities in the coming years. Bearing in mind that GFI only tracks the food portion of the bioeconomy, the fermentation capacity gap looms quite large. Enough’s Craig Johnston states: ‘Fermentation capacity is booked out everywhere – the next open slot they have is usually 2024, earliest’. Andrea Conforto, VP Olon Biotech for CDMO (Contract Development and Manufacturing Organization), adds: ‘CDMOs are, indeed, experiencing high demand for services but the CDMO industry is focussed on assisting scale-up and supporting the commercial launch of new products where possible.

Thus, businesses looking to scale up their fermentation process increasingly take on the challenge of building their own commercial scale facilities. Such fermentation facilities can easily cost tens to hundreds of millions of dollars, necessitating smart financing approaches.

One approach used across a wide range of sectors, including the clean technology sector, is project finance. In project finance, a stand-alone project company (the “ProjectCo”) is established to own the asset with only limited to no recourse to the sponsoring company. This structure separates the credit quality of the project from the credit quality of the sponsor, a desirable feature for non-credit-worthy start-ups. Project investors can then contribute capital directly to the ProjectCo based on the underlying economics of the project itself. For new facilities with unproven markets or processes, capital may require significant returns (15% or higher IRRs) and debt capital may be too risk averse to participate. Eventually, the facility’s proven performance and cashflows after the start of operations can attract cheaper capital to refinance the facility and build further facilities. Bridging this gap from higher cost of capital sources for early facilities to low cost-of-capital sources for later facilities allows for lower overall facility carrying costs as a company scales. Thus, production costs decline over time without any change in technical parameters. A potential capital sourcing approach is sketched below:

The Venture Capital (VC) equity-financed sponsor company establishes a separate legal entity to build and own a facility. Whenever possible, it makes use of government subsidies, which can range from tax advantages to infrastructure support (e.g., road access) to loans and grants. Initial engineering costs are perhaps financed via equity or, to avoid shareholder dilution, via venture debt if available to the sponsor. Once detailed engineering has specified the cost, production capacity, and COGS of the facility, lower cost capital sources may become available to finance the actual construction of a facility, for instance from private equity infrastructure investors. Additionally, lower-cost debt capital can sometimes be enabled by guarantors like governments, off-takers, or industry partners. After a project has operated for a few years, or for a second-of-its-kind facility after the first facility has a proven commercial track-record, institutional capital sources like major banks or pension funds may be an option to finance further growth and retire more expensive debt.

For many companies, a mix of capital sources will be needed, and some balance-sheet capital may need to be invested from the sponsor into the ProjectCo itself. Relationships between the company and its investors, industry partners, financing institutions, suppliers and off-takers can further help build the right capital mix. One successful fundraising example to highlight is Mycotechnology, who were able to partially debt-finance their second fermentation facility in Oman based on a good fit between their technology and a network of regional suppliers who provide locally abundant surplus dates as feedstock. This regional fit, together with a fermentation process that was already proven at their first facility, served as the basis for debt financing.

An alternative pathway being pioneered by Synonym follows lessons from commercial real-estate and data centres, wherein a specialized project developer and financier with pre-existing standardized designs and capital relationships develops and builds large-scale capacity for companies and then provides dedicated access to the facility through a long-term triple-net lease. This structure mitigates risk for project investors by allowing an investment into a portfolio of projects while minimizing the time, talent, and capital required for companies to construct their own facilities directly.

As the bioeconomy grows, institutional capital providers may develop specialized investment teams dedicated to this space, as has occurred in the renewable energy industry. Standardized criteria can then inform capital providers about the risk profile of a given project. For instance, Renewable Energy Project Rating Criteria by rating agency Fitch include factors like construction risks, operation risks, and commercial risks. By achieving an investment-grade risk profile, which means ‘mid-range’ or better risk levels, companies can follow renewables down the financing cost curve. Investment-grade risk profiles significantly broaden the possible investor set to include the wide range of investors who rely on credit ratings to make financing decisions. A ‘mid-range’ level of operation risk for a bioeconomy facility might be sketched as:

- Construction risks

- A reputable technical advisor or engineering firm provides a detailed cost analysis

- A reputable engineering, procurement, and construction (EPC) firm has provided a guaranteed maximum price (GMP) contract

- Prior facilities have been constructed on-time and on-budget using a similar technology set

- Equipment costs are spread over time via leasing agreements, lowering upfront capital requirements. Such agreements may be available with large equipment manufacturers for off-the-shelf equipment

- Operations risks

- The operator has experience with the technology at commercial scale and is (mostly) using off-the-shelf equipment.

- The strain and process have been demonstrated at a similar scale in another similar facility at the technical performance metrics (titre, yield, etc) required for profitability

- Maintenance cost is de-risked, e.g., via fixed-price maintenance agreements or proven maintenance expenses from other similar facilities

- Reference facilities are in place; these can, but do not have to be owned by the operator

- Required feedstocks and consumables are readily available and backup options are possible in the event of the failure of a provider (or provider is highly credit-worthy)

- Commercial risks

- The facility set-up allows for fungibility, i.e., it can run different fermentation processes with minimal retrofitting to diversify the potential product suite that can be produced. There are some replacement operators should the operator default.

- Input availability and cost are de-risked through supply agreements and contracts, especially for high-volume inputs like sugar

- Binding contracts are in place with reputable, investment-grade counterparties including suppliers, manufacturers, and off-takers

- The product market is well understood, durable, deep, and contracts are in place with reputable counterparties for a majority of the facility output

A more in-depth primer on biomanufacturing project development and financing strategies from Synonym is expected to be published in Q1 2023 to dive deeper into the risk areas outlined above and mitigation strategies to attract capital.

In addition to using project finance as a deal structure and building towards investment-grade risk levels, start-ups looking to scale up their process can benefit from partnering with someone who has done it before. Corporate partnerships can unlock access to key skills and infrastructure. The following case studies highlight some successful corporate partnerships in the bioeconomy.

Case studies ‘Corporate partnerships in the bioeconomy’

- ADM and NewCulture, announced 2022

ADM is a U.S. agribusiness which operates over 250 plants for food processing, with a revenue of $85B (2021). NewCulture is a producer of animal-free dairy products based on casein produced by precision fermentation. The companies announced a strategic partnership whereby NewCulture could access ADM’s plant-based ingredients and fermentation production capacity for commercial scale-up. - Cargill and Enough, announced 2022

Cargill is a U.S.-based food corporation with a revenue of $115B in 2018. Enough is a U.K. fermentation start-up, working on mycoprotein. Enough has recently established a production facility for mycoprotein, notably co-located with the Cargill facility in Sas van Gent, The Netherlands. The facility has been supported by the European Union’s Bio Based Europe Joint Undertaking fund with EUR 17 million. - AB InBev and EVERY (former Clara Foods), announced in 2021

Anheuser-Busch InBev, a Belgian company, is the world’s largest brewer, with a revenue of $55B (2021). EVERY is a U.S.-based company developing animal-free egg whites through precision fermentation. The BioBrew division of AB InBev’s venture and innovation arm ZX Ventures was established to apply AB InBev’s fermentation technology and scale to precision fermentation. The partnership with EVERY is the first of its kind and aims to produce proteins in fermenters of 500,000 to 1 million litres. - Fungi Protein Association, announced in 2022

Companies of the mycoprotein sector founded the Fungi Protein Association to accelerate the production of sustainable, fermentation-based fungi protein alternatives. Members include established food companies such as Quorn, and emerging Blue Horizon portfolio companies including Enough, Nature’s Fynd or Bosque Foods, as well as knowledge partners such as ProVeg and GFI. The association’s aims are to represent the interests of its members, to advocate for fungi protein in public policy and to conduct consumer research on their behalf.

4. Conclusion

The fermentation-based bioeconomy offers a compelling vision of the future – and to make it real, researchers, founders, governments, investors, and lenders must work together.

Every party can contribute to unlocking bioeconomy scale up:

- Researchers can select the products, and processes they focus for scalability from the start

- Founders can orchestrate the agile interaction between go-to-market planning and process development that produces a strain and process designed for target COGS and specification. They can further build their business for creditworthiness, by establishing the right legal and governance structures, leveraging subsidies, and by developing a strong network of investment-grade counterparties.

- Governments can help solve the “chicken-and-egg” problem of financing a first-of-its-kind facility for which commercial off-take agreements are hard or near impossible to obtain. Government provision of competitive programs of guarantees, loans, or grants would help innovators become large-scale economic contributors.

- Investors can use their financial expertise to help founders in their portfolio build for creditworthiness. They can also help orchestrate the agile interaction between go-to-market planning and process development, and broker value-added industry partnerships for their portfolio companies.

- Lenders can educate themselves on the bioeconomy to ensure they do not miss out on the emerging opportunity for financial returns and impact. They can help to establish standardized criteria for assessment of risk profiles, enabling founders and their investors to build for creditworthiness.

The bioeconomy is only beginning to scale. It offers elegant solutions to some of the world’s most pressing problems, from nutritious food to renewable materials. Scaling it up will require focus and coordination – but the prize makes the effort seem trivially worthwhile. The financial opportunity and potential for positive impact on planet, humans, and animals are vast.